Is the SEC Shielding Coca-Cola from Whistleblower Ray Rogers?

FOR IMMEDIATE RELEASE

CONTACT: Pat Clark, Corporate Campaign

TELEPHONE: 718-852-2808

EMAIL: info@corporatecampaign.org

TITLE: Is the SEC Shielding Coca-Cola from Whistleblower Ray Rogers?

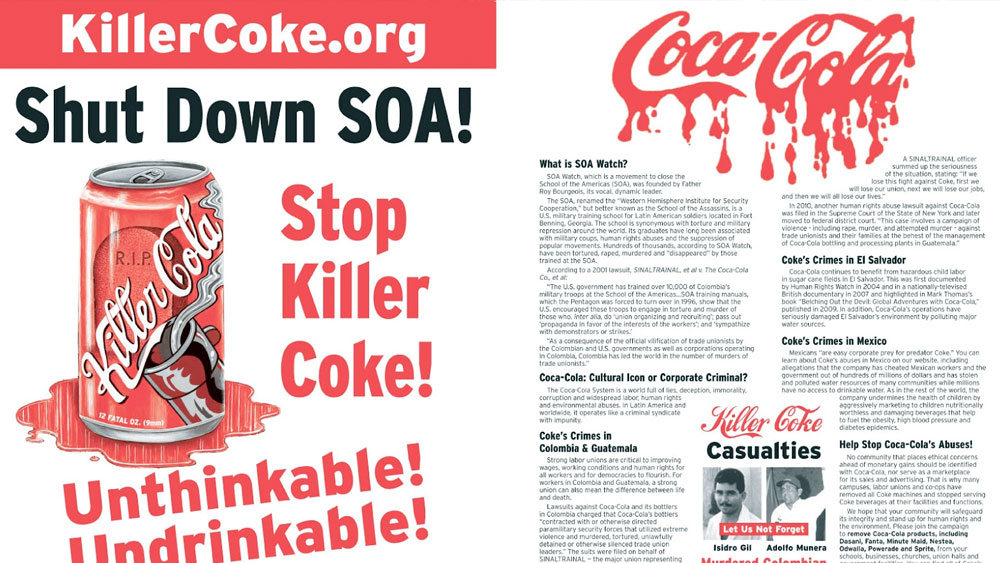

SUMMARY: Ray Rogers, Director of Corporate Campaign, Inc./Campaign to Stop Killer Coke, is challenging the U.S. Securities and Exchange Commission (SEC) over the revolving door syndrome between the agency and the corporations it is mandated to oversee. Additionally, Mr. Rogers questions if the SEC is trying to shield The Coca-Cola Company from being exposed and held accountable for worldwide labor, human rights and environmental abuses.

PRESS RELEASE — Jun. 25, 2013 — BROOKLYN, N.Y. — After Ray Rogers, Director of Corporate Campaign, Inc./Campaign to Stop Killer Coke, filed a federal whistleblower complaint against The Coca-Cola Company with the U.S. Securities and Exchange Commission (SEC), he became the target of an intimidating phone call and letter from an SEC lawyer.

Now, Mr. Rogers has to ask — Is that a coincidence or an example of the SEC attempting to shield Coca-Cola from having to reveal the truth about Rogers' whistleblower complaint? Mr. Rogers filed a whistleblower complaint with the SEC, citing potential violations of federal securities laws by The Coca-Cola Company and its Chief Executive Officer Muhtar Kent in June 2011. The complaint was updated in June 2012 and again in May 2013.

"It's difficult enough challenging the world's largest beverage company over widespread labor, human rights and environmental abuses without having the Securities and Exchange Commission trying to shield the company from exposure and accountability," said Rogers.

On April 1, 2013, Mr. Rogers was contacted by Nickolas Panos, Senior Special Counsel, Office of Mergers & Acquisitions, Division of Corporate Finance of the SEC. Mr. Panos complained about Mr. Rogers' organization's website, KillerCoke.org, and the Campaign to Stop Killer Coke newsletter. Mr. Panos wrote, "We note the assertion that readers of your newsletter might 'have concerns about the way Coca-Cola abuses people and the environment...' Similar inflammatory statements may be found at other locations on your website...Please delete these statements from the website...or provide us with the factual foundation in support."

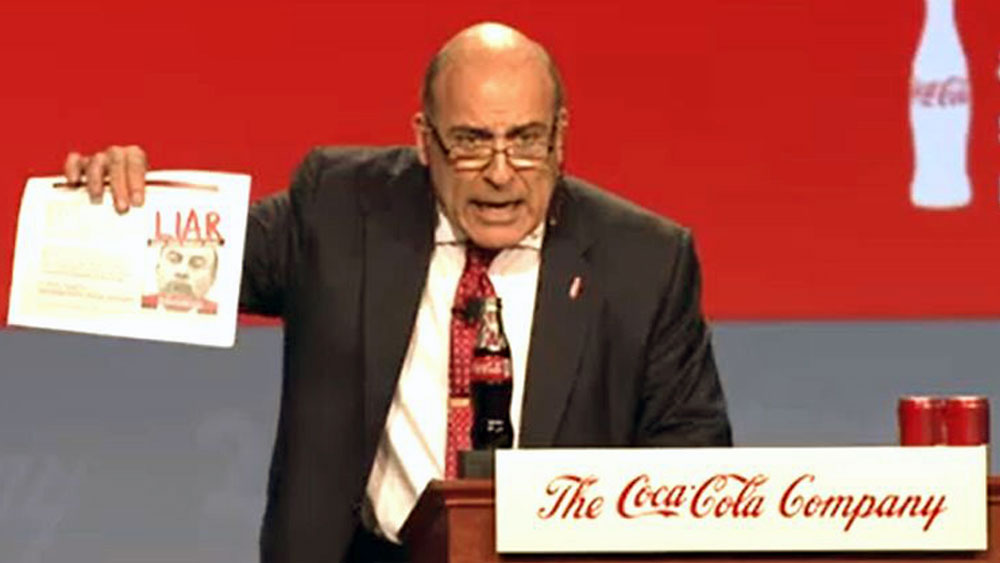

In response, Mr. Rogers, in an April 15 letter to Mr. Panos made it clear that "We stand by our statement that The Coca-Cola Company abuses people and the environment and we have no intention of deleting anything from either of our websites — KillerCoke.org or StopCokeDiscrimination.org, including posters that claim that Coke's CEO Muhtar Kent is a liar.

"I think that the SEC would want to investigate such an allegation — the SEC can read our SEC complaint filed on June 6, 2011 about Mr. Kent lying to and misleading shareholders about pending lawsuits in Mexico and behavior of the company that could have a material effect on Coke's bottom line."

Mr. Rogers then raised the question: "One has to wonder whether the SEC is overworked or the revolving door syndrome between influential SEC employees and corporations is causing a lack of investigations into, and legal proceedings against the likes of Coca-Cola by the SEC."

Mr. Rogers quoted a February 2013 report entitled, "Dangerous Liaisons: Revolving Door at SEC Creates Risks of Regulatory Capture" by the Project on Government Oversight (POGO) saying:

"Former employees of the Securities and Exchange Commission (SEC) routinely help corporations try to influence SEC rulemaking, counter the agency's investigations of suspected wrongdoing, soften the blow of SEC enforcement actions, block shareholder proposals, and win exemptions from federal law."

Michael Smallberg, author of the POGO report, stated in Corporate Crime Reporter, "The revolving door between the SEC and the firms it oversees is so pervasive that it threatens the integrity of our regulatory system. The relentless flow of SEC officials to and from industry can enable powerhouse firms to shape the SEC's culture and sway policies."

Latest Response

Mr. Rogers in a letter to Mr. Panos dated June 24, 2013, said he was still waiting a reply to his April 15th letter:

"Your lack of response to my letter after you raised very serious questions about the legality of my actions reinforces suspicions I have as to the real reason the SEC contacted me in the first place. I can't help but feel that the SEC is acting to intervene to the benefit of The Coca-Cola Company by attempting to intimidate me or otherwise curtail my activities regarding the company...

"Given all this, I still have to wonder whether the SEC has taken, or is going to take, any action on my whistleblower complaint. If no action is going to be taken, I have to ask, Why not? — especially in the face of the compelling evidence put forth regarding Coca-Cola's and Mr. Kent's clear violations of SEC rules and regulations...

"With respect to The Coca-Cola Company, it seems that the SEC is asleep on the job or that the SEC is willfully acting as a shield for the company.

"I would like to know from you, Mr. Panos, since you have reached out to me concerning my activities with The Coca-Cola Company, has the SEC done anything with my whistleblower complaint concerning my allegations of securities fraud against The Coca-Cola Company and its CEO Muhtar Kent filed with the SEC in 2011 and updated twice since?"

Regarding the revolving door, Mr. Panos' boss, Mr. Lona Nallengara, who until he was appointed Chief of Staff of the SEC on May 15, 2013, was deputy director and then acting director of the Division of Corporate Finance of the SEC. Prior to joining the SEC, Mr. Nallengara was a partner in the law firm Shearman & Sterling. On its website, the law firm boasts "The firm's lawyers include former SEC directors and senior staff members."

During Mr. Nallengara's tenure at the law firm, The Coca-Cola Co. was a client of Shearman & Sterling. In fact, the law firm represented The Coca-Cola Co. in the acquisition of Panamerican Beverages, Inc. by Coca-Cola FEMSA, which is presently Coca-Cola's largest bottler and which has been charged by my organization and others with human rights abuses in Colombia. The law firm has also represented Coca-Cola Enterprises.

SEC Chair Mary Jo White has a long history with the Debevoise & Plimpton law firm. Before becoming head of the SEC, she was chair of the law firm's Litigation Department since 2002. The law firm lists The Coca-Cola Company as a key client.

Ms. White is also a member of the Council on Foreign Relations and, although the Council has many members, it should be noted that eight members of The Coca-Cola Company's board of directors and a former Coca-Cola CEO are also members, and Coca-Cola CEO Muhtar Kent is one of 36 members of the Council's board of directors.

The firms that have Coca-Cola as a client and have former SEC employees working for them include: Debevoise & Plimpton, Ernst & Young, Katten Muchin Zavis Rosenman, King & Spalding, McKenna

Long & Aldridge, Proskauer & Rose, Ropes & Gray, Shearman & Sterling and White & Case. Has this had an effect on the SEC's hesitancy/refusal to investigate The Coca-Cola Co.?

For the past two years, Coca-Cola's Annual Meeting of Shareowners has become little more than a complete charade and this should be of great concern to the SEC, to shareholders and to any other regulatory and enforcement authorities about the legitimacy of these meetings to serve as a vehicle to seek answers to serious questions and to hold executives, board members and auditors accountable. For example, Mr. Kent, for the second year, did not provide time to allow any questions relating to business agenda item #2 "to ratify the appointment of Ernst & Young LLP as independent auditors of the Company to serve for the 2013 fiscal year."

Prior to joining Coca-Cola in 1994, Gary Fayard served 19 years with Ernst & Young. Since 2003, Mr. Fayard has been the Executive Vice President and Chief Financial Officer of The Coca-Cola Company. Mr. Fayard was on the board of Panamerican Beverages when it was acquired by Coca-Cola FEMSA. He then became a board member of Coca-Cola FEMSA. As we mentioned above, SEC's Chief of Staff Lona Nallengara's law firm, Shearman & Sterling, represented The Coca-Cola Co. in the acquisition of Panamerican Beverages by Coca-Cola FEMSA.

The POGO report listed 15 former SEC employees who filed disclosure statements from 2003 to 2011 who went to work for Ernst & Young!

Corporate Campaign, Inc., headquartered in New York City, and its director, Ray Rogers, have been helping labor unions, human rights and environmental groups and others struggle for justice and achieve major victories since its founding in 1981 — www.CorporateCampaign.org

— End —