Coke Warns of Slack Sales for a Year or So

By MELANIE WARNER | The New York Times | November 12, 2004

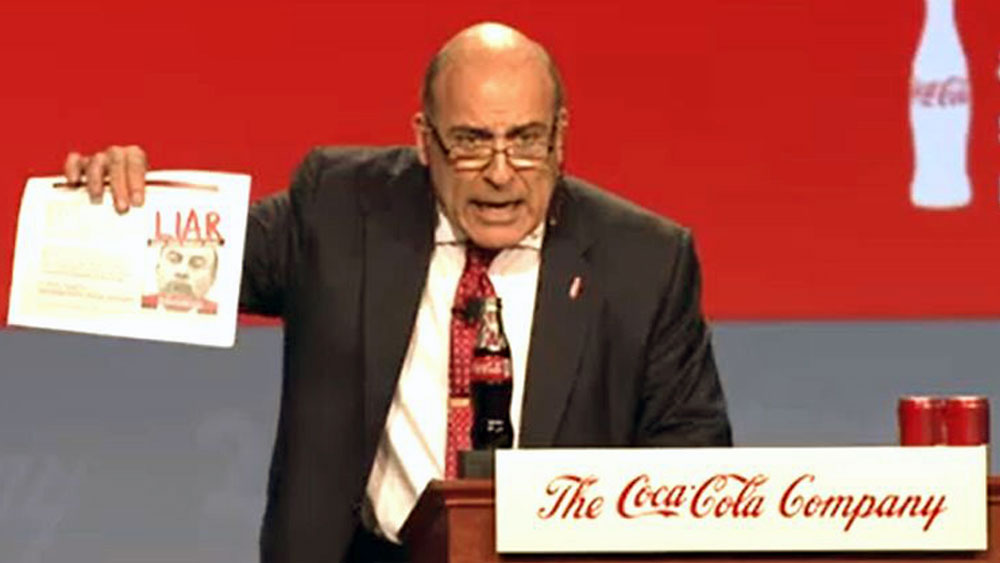

Coca-Cola, suffering from weak sales in North America and other important markets, said yesterday that it would sharply scale back its projections for the amount of beverages it expects to sell in future years and the profit it hopes to generate. Speaking to a group of analysts and investors at the Plaza Hotel in Manhattan, E. Neville Isdell, Coke's chief executive, promised to improve the company's long-term profitability eventually, but warned that 2005 would be a "transition year."

Mr. Isdell said that Coke was now concentrating on sales volume growth of 3 percent to 4 percent, instead of earlier targets of 5 percent to 6 percent. Operating income is now expected to increase 6 percent to 8 percent, compared with the earlier target of 10 percent.

The new growth targets do not apply to 2005, which is expected to fall short. Coke reiterated its already reduced 2004 earnings forecast of $1.88 to $1.90 a share.

Mr. Isdell warned investors that they should not expect to see any significant improvements in Coke's results for 18 to 24 months. "We have underperformed since 1997," he said.

In trading Thursday, Coke's stock price fell 21 cents a share, closing at $40.96.

Like many big food and beverage companies, Coke has felt the effect of consumer concerns about health and obesity in affluent areas of the world like the United States and much of Europe.

In the United States, sales of some of Coke's health-oriented brands — Odwalla juice and Dasani bottled water, among them — are up considerably, while sales of its flagship Coke Classic, with 39 grams of refined sugar in a 12-ounce can, have been sliding.

Dasani's sales have grown 6.9 percent in the last year, according to the research firm Information Resources, and Odwalla, which Coke bought three years ago, has surged 18.8 percent.

By comparison, retail sales of Coke Classic are down 5.7 percent for the first nine months of this year, according to the trade publication Beverage Digest.

Mr. Isdell acknowledged that Coke had not responded quickly enough to widespread health concerns, but he vowed to change that. "Carbonated soft drinks are going to be carriers of health and wellness benefits," Mr. Isdell said. "We don't have it now, but we're looking into it."

Coke, according to John Sicher, editor and publisher of Beverage Digest, is now rushing to develop products with nutritional supplements, similar to 7Up Plus, a carbonated fruit drink containing vitamin C and calcium.

Mr. Isdell was named chief executive in May, succeeding Douglas N. Daft, who announced his retirement in February after he lost the confidence of the board amid poor earnings gains and strained relationships with bottlers.

An Irish native, Mr. Isdell is a longtime Coke insider who first joined the company in 1966, working at a bottler in Zambia. He rose rapidly through the ranks and then left the company in 2001, spending several years serving on other boards and running his own investment fund before returning to Coke.

Coke's lackluster performance recently contrasts sharply with its booming sales and earnings in the mid-1990's, when the company was consistently chalking up double-digit sales gains year after year and generating robust profits.

In the United States, all the major soft drink makers have been doing poorly but the retail sales performance of Coca-Cola's carbonated business lags both of its top competitors, Pepsi-Cola and Cadbury Schweppes.

Over the last nine months, Coke's total retail unit case volume &3151; a leading sales measure in the beverage industry — has declined 5 percent, according to Beverage Digest. Pepsi's soda business has dropped 2.5 percent and Cadbury Schweppes's was down 0.8 percent.

Pepsi put out a statement reaffirming its outlook.

A major part of Mr. Isdell's plan to turn around the 118-year-old company is a renewed emphasis on marketing and advertising. Starting next year, he said, Coke planned to add $350 million to $400 million to its annual marketing budget. "This isn't a short-term fix," Mr. Isdell said. "It's about what we need to do about putting fuel back in the system for the long term."

Mr. Isdell said that much of that additional spending would be focused on low-calorie drinks and on making further inroads in developing markets elsewhere in the world.

Coke vowed to spend the additional money more wisely than it has lately, avoiding marketing missteps like the start of the disappointing C2 "mid-calorie" soda in June.

Analysts fault the company for pricing C2 too high and using strange packaging strategies. "They charged more for it and almost tried to trick the consumer by putting eight cans in a pack instead of twelve," said Erin Ashley Smith at Argus Research. "And they didn't put it into a liter bottle, which is a value buy."

Chuck Fruit, Coke's chief marketing officer, said the company would do less "tactical" and local advertising and devote more attention to television ads that promote the broad appeal of Coke.

"Candidly, our company's advertising in the past few years has not been as effective as it needs to be," Mr. Fruit said. "We want to promote the bigger global ideas that are based on universal human insights."

Mark Mathieu, vice president for corporate marketing, referred to Coke's popular "Hilltop" ad, with its song, "I'd like to buy the world a Coke," as a model for the kind of emotionally powerful marketing the company wants to bring back. Any Coke turnaround will inevitably require internal transformation. Since 1999 the company has undergone two rounds of traumatic layoffs, a succession of management troubles and investigations by the Securities and Exchange Commission and the F.B.I.

Mr. Isdell said that a big part of his job was restoring the wounded morale at company headquarters in Atlanta and in its operations around the world.

"The two organizational realignments we've done have taken the trust that had been in place for 118 years out of the system," he said. "Today we're at the stage where people are willing to start believing again."

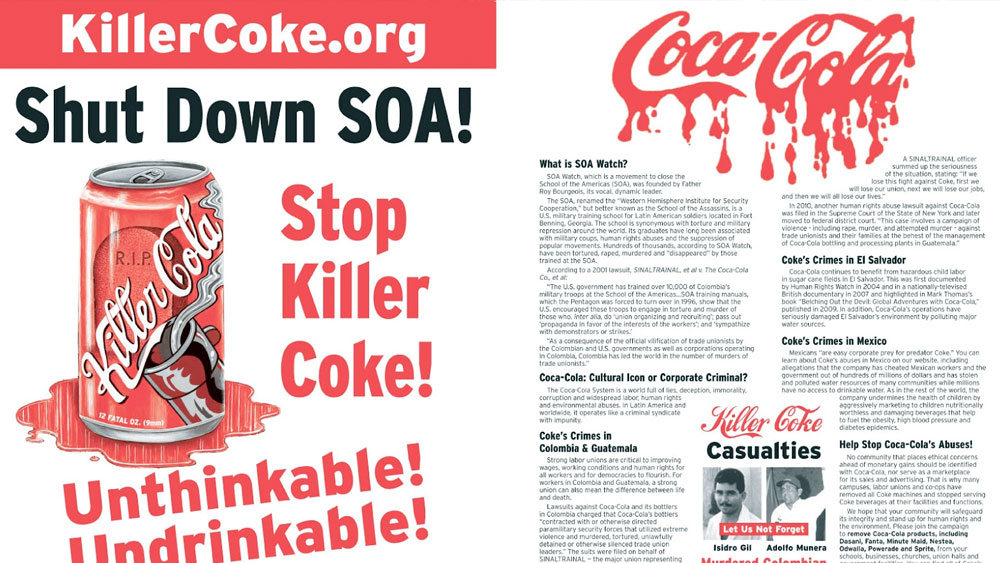

FAIR USE NOTICE. This document contains copyrighted material whose use has not been specifically authorized by the copyright owner. The Campaign to Stop Killer Coke is making this article available in our efforts to advance the understanding of corporate accountability, human rights, labor rights, social and environmental justice issues. We believe that this constitutes a 'fair use' of the copyrighted material as provided for in section 107 of the U.S. Copyright Law. If you wish to use this copyrighted material for purposes of your own that go beyond 'fair use,' you must obtain permission from the copyright owner.